Credit Card Bill Needs Support

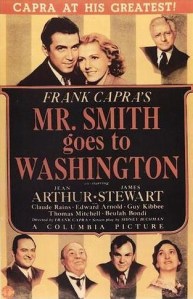

Citizen Lobbyists

OK, I went to Washington and lobbied for S. 414, the Credit Card reform bill. Here’s what happened. We started the day at Sen. Mary Landrieu’s office, so I was up first. The staffer (I don’t recall his name but will update this when I get it) we met with was a bit cynical. I was disappointed. I tried to emphasize that the banks were harming Sen. Landrieu’s strongest supporters and that it was time for her to stand up for the poor people who vote for her. He basically dismissed that line of thinking since the next election is years away. He claimed that Sen. Landrieu wasn’t afraid of angering the bankers (not that we said anything like that, though she is the recipient of more than $2 million in banking lobby money) because she had supported a credit union bill vehemently opposed by banks. We tried to get him to admit the banks were screwing us with these rate hikes, fees and other onerous new burdens. But he never seemed to sympathize.

Next we met with Travis Johnson, a legislative assistant with Sen. David Vitter. We we engaged by a smart, civil staffer who challenged us, debated us and gave us an opportunity to rebut and refine our arguments. We might not have changed the way Vitter will vote. But we had an intelligent and satisfying discussion with his staffer.

We also visited with very receptive staffers in the offices of Virginia Senators Mark Warner and Jim Webb.

We were a small group, me, 2 from Virginia and 1 from Connecticut. We were led by representatives of Consumers Union, the Pew Charitable Trusts and the Center for Responsible Lending.

Despite the fact that Sen. Landrieu’s opposition might be enough to stop the bill, there is a sense of optimism that credit card reform will pass. We were promised that if there is a signing ceremony with President Obama, that we’d be invited back!

I’m grateful to Consumers Union and the Pew Charitable Trusts for this amazing opportunity. It was amazing to see how accessible our federal delegation is to visits. I would advise anyone seeking to be heard to take the time to visit Washington and make an appointment. A staffer will be assigned to meet with you and give you the chance to be heard. Whether they listen is another story all together. But the experience is worth it because if you don’t try, nothing is guaranteed to happen.

Please call Sen. Landrieu’s office at 202-224-5824 and Sen. Vitter at 202-224-4623 and tell them you support credit card reform and want the senators to support their constituents and rein in the banks. The vote could happen this week or early next week, so call ASAP!

Heading to Washington to be a Citizen Lobbyist for Credit Card Reform

Consumers Union called Friday afternoon to offer me the opportunity to join them in the Capitol this week to lobby for passage of S. 414, the Credit Card Accountability and Responsibility Act. It seems that my participation in advocating for passage via http://creditcardreform.org caught their attention. My story was “one of the more credible ones” they’ve gathered and they want me to be a citizen lobbyist on Monday and Tuesday (May 4-5). They are covering the cost of the trip thanks to the support of the Pew Charitable Trusts.

Consumers Union called Friday afternoon to offer me the opportunity to join them in the Capitol this week to lobby for passage of S. 414, the Credit Card Accountability and Responsibility Act. It seems that my participation in advocating for passage via http://creditcardreform.org caught their attention. My story was “one of the more credible ones” they’ve gathered and they want me to be a citizen lobbyist on Monday and Tuesday (May 4-5). They are covering the cost of the trip thanks to the support of the Pew Charitable Trusts.

I’m stoked, because Sen. Mary Landrieu is one of only 2 Democrats sitting on the fence regarding S. 414. She unfortunately voted to defeat the mortgage relief bill last week, saying that “my community bankers could be hurt.” Uh, Sen. Landrieu, your community is being hurt and we are the ones who elect you–by very slim margins each election–not the bankers.

FYI, Bank of America recently raised the rate on my credit card to 28% for no other reason than I have a fairly high balance. I have not missed a payment on any of the many cards I have and my credit is good. I’ve been quite outraged about this and sent emails to all my elected officials in Washington via the Consumers Union site. That’s what produced the phone call.

I’m going to be part of a team of citizen lobbyists working with Consumers Union this week. We’ll be calling on senators (the bill already passed the House) and their staffers, telling our stories and demanding passage of S. 414.

If you don’t already know, S. 414 protects consumers from unreasonable rate increase, bans marketing credit cards to people under age 21, sets clearer guidelines for gift cards (not allowing fees or expiration) and provides for higher deposit insurance levels–a component that also helps banks. The banking industry is squealing because the card limits hit their profit margins. But, had these despicable, greedy institutions done a better job of running fair businesses, they wouldn’t be complaining and we wouldn’t be rebelling against their usurious and unreasonable rates. What banks are doing to customers, young and old, is morally reprehensible.

You cannot escape from credit card debt, thanks to a bill passed by a bipartisan Congress during the Bush years. And now, there is blood on their hands. People are comitting suicide and murder over their indebtedness. (See Maxed Out, the 2006 documentary that exposes how banks and government created this mess.) We have to do something.

So, my advice to you is to become a member of Consumers Union, the nonprofit arm of Consumer Reports, and any other reputable organization fighting for the rights of the people. You never know, you might get to go to Washington, too.

You must be logged in to post a comment.